- California Assembly OKs highest minimum wage in nation

- S. Korea unveils first graphic cigarette warnings

- US joins with South Korea, Japan in bid to deter North Korea

- LPGA golfer Chun In-gee finally back in action

- S. Korea won’t be top seed in final World Cup qualification round

- US men’s soccer misses 2nd straight Olympics

- US back on track in qualifying with 4-0 win over Guatemala

- High-intensity workout injuries spawn cottage industry

- CDC expands range of Zika mosquitoes into parts of Northeast

- Who knew? ‘The Walking Dead’ is helping families connect

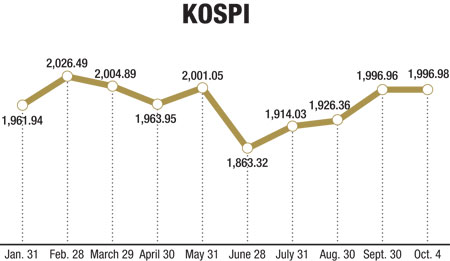

KOSPI: a shining star in Asia

By Lee Hyo-sik

The Korean stock market has been outperforming other emerging markets in recent months on the back of strong foreign buying, driven by the nation’s sound economic fundamentals.

Most analysts project that the local bourse will likely continue its bullish run for the remainder of the year, despite a host of lingering issues such as the timing and scope of U.S. QE easing and U.S. government shutdown.

The U.S. Federal Reserve’s Sept. 18 decision not to taper its bond buying has surprised investors around the world. Market analysts expected U.S. policymakers to reduce its $85-billion-a-month bond-buying program by $10 to $15 billion in September.

But the U.S. central bank decided to keep its easy-money stimulus program in place for the time being to spur sluggish economy. Federal Reserve Chairman Ben Bernanke said the agency plans to continue purchasing bonds to pump money into the world’s largest economy until it shows genuine sign of improving.

Korean analysts say that the delayed QE exit will barely exert influence over the global equity market. Others say it points to lingering weakness in the U.S. economy and increases market uncertainties, which makes it more difficult to project the direction of the global financial market.

The ongoing partial U.S. government shutdown has added to deepening uncertainties, but analysts don’t expect it to last long and believe it won’t negatively affect equity markets.

To help investors navigate in increasingly uncertain waters, The Korea Times’ Business Focus asked four equity analysts with extensive research experience about the future course of the Korean stock market.

The analysts are David Chon, CEO of KDB Asset Management; Cho Yun-nam, head of research at Daishin Securities; Lee Jong-woo, managing director of I’M Investment & Securities, and Hong Sung-guk, executive vice president of KDB Daewoo Securities.

The analysts say the Korean market has outperformed other emerging markets in recent months, thanks to ample foreign currency reserves, large trade surplus and other sound economic fundamentals. They say local shares will likely increase in value with active foreign buying, pushing the benchmark KOSPI to as high as 2,200 by the end of this year.

Experts project the Federal Reserve will begin buying fewer bonds in December or in January, but they believe its impact on the local market will be minimal.

They also say the ongoing partial U.S. government shutdown on Oct. 1 will be short-lived and won’t negatively affect equity markets across the globe.

Mixed reviews on delayed QE exit

Experts are split over the latest Fed’s decision to keep the bond-buying program intact.

Hong of KDB Daewoo Securities said the delay will continue to keep global liquidity ample. “But it also shows that the Federal Reserve lacks confidence in the U.S. economic recovery. To sum it up, the tapering has merely been postponed and I don’t think it will have a significant impact on stocks and other assets.”

Cho of Daishin Securities said the Fed’s move adds to policy uncertainty by giving rise to numerous speculations on the timing and scope of tapering.

“It raises questions about American economic fundamentals. By the same token, we may argue for a bond rally, which could reverse the ‘great rotation’ or hold off money inflows into stocks,” Cho said. “There is still hope that money will flow back into Korean stocks once investors confirm healthy third-quarter growth numbers from China and Korea in mid-October.

Chon of KDB Asset Management and Lee of I’M Investment & Securities see the Fed’s decision more negatively.

“The impact from the Fed’s decision for Korea could be felt over the medium-term and it could be profound,” Chon said. “The Fed admitted two things with this move. First, the U.S economy is not strong. Second, the debt level for the U.S. is such where incremental rise in borrowing cost is harmful to its nascent economic recovery.”

Chon, who is a former Wall Street investor, says the quantitative easing was always viewed as an emergency measure. “It was supposed to prevent depression and help the U.S. financial system to regain balance. It was never intended to fix the balance sheet for the country. The potential adjustment from the exit is now greater for many economies and markets around the world.”

Chon believes deferred pain will only make the eventual adjustment much more harmful to Korea.

Lee also echoed Chon’s view, saying that the latest Fed decision points to a fragile U.S. economy, despite its massive expansionary monetary policies since the collapse of Lehman Brothers in 2008.

“Knowing that the U.S. will soon begin tapering, investors will act accordingly. This will inevitably reduce the size of foreign buying of Korean and other emerging market stocks,” Lee said.

Fed expected to taper in December

Analysts project the Fed will begin to reduce the number of bonds it buys by the end of the year.

“I think the Federal Reserve will start to taper in December and this will be neutral for the Korean market,” Hong said. “If the U.S. economy shows signs of a visible rebound before the tapering, the local bourse will be able to break the current box pattern.” KOSPI has been hovering at 1,850 and 2,000 for months.

Cho says when the U.S. government buys fewer bonds it won’t hurt the global economy because the country is showing enough signs of recovery to sustain its influence.

“Tapering in December is highly likely. It’s too early to tell whether or not the job market situation is really improving because manufacturing hiring activity is still very much weak,” he said. “The best time for the U.S. to pull back easing is when the jobless rate, which now stands at 7.3 percent, goes down below 7 percent, or when manufacturing shows signs of trending up, hence December.”

Cho said the tapering move’s impact on Korean stocks would be further limited by China’s third-quarter growth, which is expected to top 7.5 percent.

Lee agreed with Hong and Cho, saying the Fed will begin to reduce its bond buying either in December or January next year.

“The tapering is not a market variable anymore. We all expect it to happen. This means it won’t have much impact when it happens,” he said.

However, Chon disagreed with the rest of the analysts, saying that the exit will not materialize any time soon. It will negatively affect Korean stocks, he said.

“It is hard to guess the timing. Some are speculating that it will be before the Chairman Bernanke’s term ends in January. This will put the exit around the year-end,” Chon said. “The impact on the Korean market will be negative. Some will be direct, like lower profit from slowing U.S. and increased market volatility. Some will be indirect through a much more powerful impact to other emerging economies.”

He then stressed the Fed decided not to cross this bridge yet. “If the condition for the exit from QE is strong growth and low interest rates, it is not clear that the Fed will exit from QE anytime soon.”

Limited impact from U.S. government shutdown

Analysts said the ongoing U.S. government shutdown, which was caused by the failure to reach an agreement on budget bills between President Barack Obama and the Republican-controlled House of Representatives, would have only marginal effects on local stocks.

“I don’t think it will have a significant impact on the Korean market. This is a mere political event and it won’t last long,” Cho said. “If it happened when the economy goes down, it would have exerted greater influence. But now that the U.S. economy is improving, the shutdown doesn’t matter much.”

Lee also thinks U.S. politicians will reach an agreement to end the shutdown. “The event is no big deal in the eyes of investors, but the bigger problem is whether or not politicians can reach a deal to raise debt ceiling before the Oct. 17 deadline. If they can’t, it could send an enormous shockwave across the globe.”

Chon also echoed the views of Cho and Lee, but said the debt ceiling is a much larger issue for investors.

“The government shutdown will be over soon, but if it does drag on, it will bring down the U.S. growth rate,” he said. “Investors will pay more attention to how the U.S. deals with raising its debt ceiling. It is not a favorable factor for global investors.”

KOSPI may reach 2,200 by the year’s end

Cho projected that the benchmark KOSPI will continue its upward trend into the fourth quarter, given favorable economic conditions. That means the benchmark could reach around 2,200 by the year’s end.

“First, there are high expectations for Korea’s economic momentum in light of China’s strengthening economic numbers. Second, the KOSPI is cheaper than its peers after its underperformance in the first half,” he said. “This is why foreign investors have bought local shares. I think foreign buying will continue. It will peak in October as the Korean won continues to gain strength, lowering expectations for further stock gains.”

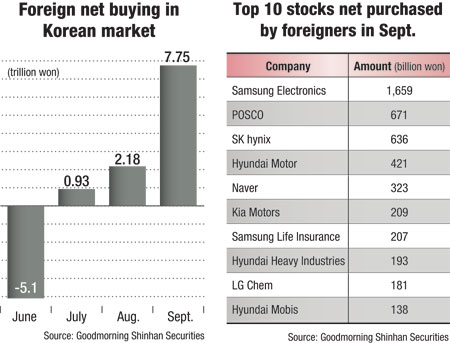

According to Goodmorning Shinhan Securities, foreign investors net purchased local shares, worth 7.75 trillion won ($7.18 billion), listed in KOSPI and KOSDAQ markets in September, up from 2.18 trillion won in August. Samsung Electronics was their favorite, followed by POSCO, SK hynix and Hyundai Motor.

Hong said KOSPI would fluctuate between 1,900 and 2,100 in the fourth quarter, while Lee puts KOSPI’s year-high at 2,050.

“Foreign investors flock to the Korean market as Asia’s fourth largest economy has performed better than other emerging economies in recent months,” Hong said. “Following the delay of the U.S. QE exit, global investors prefer emerging market assets. If the global economy picks up, Korea will be one of the countries that reap the biggest benefit, thanks to its export-oriented economic structure.”

Chon also said Korea’s economic fundamentals are much better than other emerging countries. “Many global investors found refuge in Korea as other large emerging markets went through a very eventful summer. Some of the cash flow into Korea is due to the relative-attractiveness of Korea within emerging markets and Asia.”

However, emerging markets won’t continue to attract long-term global investment, he said. “Risks in some emerging countries are very real and substantial. If there are events which cause global investors to take money out of emerging markets, it is not clear if Korea will continue to receive interest from foreign investors.”

In light of foreigner’s massive purchase of local stocks, analysts beleive economy-sensitive, cyclical stocks will outperform defensives, advising retail investors to take more risks in the coming months.

“I favor materials, industrials and financials,” Cho said. “China’s third-quarter economic numbers due on Oct. 18 will trigger upside, and materials, industrials and financials will stand out. Improving macroeconomic conditions will add support to corporate earnings optimism, which should push stocks higher.”

Lee said stocks in transportation, chemicals and shipbuilding sectors will outperform the overall market. “I favor Korea Air, LG Chem and Hyundai Heavy Industries. These stocks are all industry leaders and when the economy improves, they pick up the momentum fast.”

The analysts then called on retail investors to refrain from seeking short-term profits.

“It is understandable that investors want to exit the market whenever stocks move upward, given the lackluster market for the past few years,” Hong said. “But investors should take a more long-term approach and plan at least five years ahead. I strongly advise clients to put money into installment funds.

Chon said selling when stocks are high and buying when they are low is the right strategy for investors. “This is a very rational behavior for a market that has been range-bound over a long-term. What is unfortunate is that this strategy does not foster development of a long-term investment culture. I think over time, Korea does need to develop a long-term investment culture.”

He stressed that the nation can develop an investment culture that is dependent on fundamental and long-term factors. “Only then, perhaps, Korea can break out of the current range bound situation.”

Cho said the local exchange shows signs of an upturn. “Corporate earnings will live up to expectations. Investors are advised to buy into stocks now rather than later because they will have to pay higher prices for stocks if they wait too long.”

Negative on real estate market

All four analysts say now isn’t the time to invest in real estate, despite signs of improvement.

Cho said the domestic housing market is finally making a comeback as the government’s policies are starting to achieve desired effects. “It is too soon to predict a housing price rally because more time for improvement. That said, we believe the government’s policies are working to keep housing prices from falling further.”

Hong said rising housing prices is a positive sign, but that doesn’t mean it’s time to invest. “I think home prices will steadily rise throughout 2014. It will be difficult to realize huge capital gains as in the past. But for those seeking to find a place to live, now is the right time to buy a house.”

Chon believes the real estate market is vulnerable to the U.S. QE exit. “I think the property market is determined by supply and demand in the long run. One can influence demand by making the financing easier and cheaper but these carrots cannot overcome a substantial supply overhang.”

The former Wall Street investor said with an aging population and smaller family sizes, the real estate market will not be booming anytime soon.

http://beats-by-dre-pro.bikeshopchicago.com

October 16, 2013 at 11:43 PM

I need to to thank you for this good read!! I absolutely loved every little bit of it.

I have got you bookmarked to look at new stuff you post….