- California Assembly OKs highest minimum wage in nation

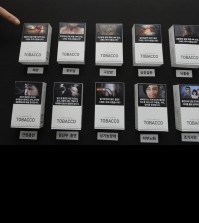

- S. Korea unveils first graphic cigarette warnings

- US joins with South Korea, Japan in bid to deter North Korea

- LPGA golfer Chun In-gee finally back in action

- S. Korea won’t be top seed in final World Cup qualification round

- US men’s soccer misses 2nd straight Olympics

- US back on track in qualifying with 4-0 win over Guatemala

- High-intensity workout injuries spawn cottage industry

- CDC expands range of Zika mosquitoes into parts of Northeast

- Who knew? ‘The Walking Dead’ is helping families connect

Samsung execs investigated for possible insider trading

In this July 17, 2015 file photo, employees walk past a logo of Samsung Group at the head office of Samsung C&T Corp. in Seoul, South Korea. South Korea’s financial regulator said Friday, Dec. 4, 2015 it has launched an investigation into possible insider trading by Samsung executives related to a contentious takeover deal. (AP Photo/Ahn Young-joon, File)

SEOUL, South Korea (AP) — South Korea’s financial regulator said Friday it is investigating possible insider trading by Samsung executives related to a contentious takeover deal.

Kim Hong-sik, director of the capital markets investigation unit at the Financial Services Commission, said South Korea’s stock exchange reported the suspected insider trading or share manipulation.

South Korea’s Yonhap News reported that nine Samsung executives purchased as much as 50 billion won ($43 million) of Cheil Industries stock before Samsung announced a deal to combine Cheil and another Samsung company in May.

Shares of Cheil, which has members of Samsung’s founding Lee family as majority shareholders, surged after the announcement.

Kim said the investigation was related to the deal but declined to discuss other details because the matter was under investigation.

In a statement, Samsung described the investigation as being in its “early stage.”

The Cheil Industries and Samsung C&T deal was contested by some shareholders of Samsung C&T who questioned its fairness.

Samsung C&T narrowly won a shareholder vote in July, allowing the transaction to go ahead. The combined entity has Samsung Electronics’ vice chairman Lee Jae-yong as the majority shareholder giving him effective control of its 4 percent stake in Samsung Electronics, the Samsung conglomerate’s crown jewel.

The most outspoken opponent of the deal was U.S. hedge fund Elliott Associates, which eventually lost its legal fight to stop Samsung from combining the two companies.

Elliott argued the takeover unfairly benefited Samsung’s founding family and other shareholders in Cheil at the cost of shareholders in Samsung C&T.

The fight between Elliott and Samsung drew international attention as Samsung’s all-out campaign was at one point criticized by Jewish organizations for depicting Elliott’s founder as a ravenous, big-beaked vulture.

Pingback: Korea Exchange Stock Market Samsung | Stock Market Futures