- California Assembly OKs highest minimum wage in nation

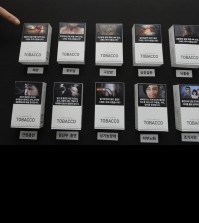

- S. Korea unveils first graphic cigarette warnings

- US joins with South Korea, Japan in bid to deter North Korea

- LPGA golfer Chun In-gee finally back in action

- S. Korea won’t be top seed in final World Cup qualification round

- US men’s soccer misses 2nd straight Olympics

- US back on track in qualifying with 4-0 win over Guatemala

- High-intensity workout injuries spawn cottage industry

- CDC expands range of Zika mosquitoes into parts of Northeast

- Who knew? ‘The Walking Dead’ is helping families connect

As the rest of the world dumps Chinese stocks, some wade in

A Chinese stock investor monitors stock prices at a brokerage house in Nantong in eastern China’s Jiangsu province Wednesday, Jan. 6, 2016. (Chinatopix via AP)

NEW YORK (AP) — While the rest of the world scrambles to get out of the crumbling Chinese stock market, a trickle of investors is heading straight into the wreckage.

Managers of Chinese stock mutual funds have seen huge drops many times before, and they even find things to like about them. Instead of taking cover, and preserving cash in their portfolios, this time these managers say they are buying stocks of companies set to take advantage of how the Chinese government is reshaping the economy.

This most-recent plummet has been even swifter and sharper than past ones, but managers of Chinese stock funds say it’s also brought down share prices enough that they’ve been buying companies that they thought were too expensive just a few months ago.

The MSCI China index has had seven declines of at least 10 percent over the last five years, including the 19 percent tumble since late October, which itself followed a 34 percent plunge from April into September by just weeks. After all those ups and downs, the MSCI China index has lost 12 percent over the last five years and is close to its lowest level since the summer of 2009.

That’s why fund managers say an investment in Chinese stocks will require lots of patience, maybe even a decade. Oberweis’ fund, for example, has lost 15.9 percent over the last year, even though it’s been one of the top performers in its category. But over the past 10 years, it’s returned an annualized 8.9 percent, better than the S&P 500′s 6.1 percent annual return.

WHAT’S CAUSING THE PANIC

China’s economy grew last year at its slowest pace in a quarter century, and economists expect it to slow even more this year. Part of that is by design. The Chinese government is steering the economy toward consumer spending and away from exports and investments in infrastructure. It hopes that will yield a more sustainable, though slower, rate of growth.

The government is also pushing anti-corruption measures and efforts to make the country’s huge state-owned banks and telecom communications companies more efficient.

The goal is to try to slow growth without stopping it. The worry is that the government will lose control of the slowdown, and the economy will fall hard.

“It’s painful at the moment, and there could be some more pain to come,” says Jasmine Huang, manager of the Columbia Greater China fund. “Eventually it will be good for the economy.”

Huang is avoiding companies from what’s known as “Old China” and owns no raw-material producers and few companies in the industrial and energy sectors. But instead of hiding out in cash, she has been investing in “New China.” She has been focusing on e-commerce companies, where she expects revenue to grow even if the overall economy stumbles because more Chinese shoppers are going online.

She also sees big growth for health care companies. They make up only about 2 percent of the MSCI China index, and she says they could grow to become the 10 or 20 percent of the market that health care represents in developed markets.

WHY THIS DECLINE IS DIFFERENT

Andrew Mattock, lead manager at the Matthews China fund, understands if investors are feeling gun-shy about Chinese stocks. “For five years now, if you’ve made money, it’s been hard to get, and you’ve lost it quickly in these sell-offs,” he says.

But the most recent drops for Chinese stocks have brought them close to their cheapest level since the financial crisis, relative to their earnings. The MSCI China index was recently trading at about 8.5 times its expected earnings per share over the next 12 months. That’s down from a price-earnings ratio of nearly 10 at the start of the year and approaching the 6.8 ratio of 2008.

Mattock, like Huang, has steered his fund toward stocks that he sees profiting from China’s shift toward consumer spending. His top holdings at the start of the year included Tencent, which operates the popular WeChat social media service, and JD.com, one of China’s largest e-commerce sites.

“This time, I think, is different because there’s actually change going on now,” Mattock says of the economic reforms underway in China. “There are doubts about whether they can do it, but what they’re trying to do is positive.”