- California Assembly OKs highest minimum wage in nation

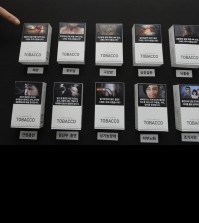

- S. Korea unveils first graphic cigarette warnings

- US joins with South Korea, Japan in bid to deter North Korea

- LPGA golfer Chun In-gee finally back in action

- S. Korea won’t be top seed in final World Cup qualification round

- US men’s soccer misses 2nd straight Olympics

- US back on track in qualifying with 4-0 win over Guatemala

- High-intensity workout injuries spawn cottage industry

- CDC expands range of Zika mosquitoes into parts of Northeast

- Who knew? ‘The Walking Dead’ is helping families connect

Can Samsung’s new low-end smartphones recoup profit drop?

SEOUL (Yonhap) — Samsung Electronics Co., the world’s top smartphone maker, has stepped up its mid- to low-end lineups as part of a revamp to overcome eroding profit and stay atop in the global market against up-and-up Chinese rivals, analysts said Tuesday.

The tech bellwether unveiled two mid-tier smartphones Galaxy A and A5 on Oct. 31 for a November launch in China, and other emerging countries to follow suit.

The Galaxy A series touts a metallic exterior and comes in several different colors including pink and gold, which Samsung said were made to woo the younger generation in the world’s most populous market.

The release of Galaxy A models indicates Samsung is leaning toward cheaper phones to retain its market clout in the saturating business, analysts said.

“The time frame for IT devices is getting shorter. Today (the product) is high-end, and in the next three years it finds itself in the bottom end. It’s extremely hard to maintain the (market) share,” said Kim Young-chan, an analyst at Shinhan Investment Corp.

Samsung has seen a sharp fall in profit since late last year. Its operating income and net profit both plunged to the lowest level in three years in the July-September quarter.

Waning sales of its flagship Galaxy handsets in China, the No. 1 market for the Korean conglomerate, were cited as key downside factors that brought the sluggish results.

Robert Yi, the head of Samsung Electronics’ investors relations, told a conference call after it reported the weaker third-quarter earnings on Oct. 30 that Samsung failed to “act swiftly to the fast-changing market.”

The behemoth has been losing its global market share to smaller Chinese rivals, to 24.7 percent as of end-September from 35 percent a year earlier, the latest data by Strategy Analytics showed.

In the low-tier smartphone market, it fell behind Lenovo Group Ltd. for the first time in the second quarter.

The robust growth of Xiaomi Inc., a Beijing-based upstart that mainly sells mid- to low-end handsets, has put increasing pressure on Samsung to overhaul its tactics.

Samsung had focused more on premium models like the latest Galaxy S5 and phablet type Galaxy Note 4, vying with Apple Inc.’s iPhone series.

Analysts, though, remain in doubt whether the lower pricing strategy will bring the top smartphone maker tangible improvement in future earnings.

The fourth-quarter outlook for Samsung Electronics paints a brighter picture, likely to post a moderate on-quarter growth, but many of analysts agreed that low-end models will not be enough to make a breakthrough.

“We may say the worst has passed. But it’s hard to say for sure profit will improve given that the market is so competitive and the popularity of the new iPhone 6,” said Lee Min-hee of I’M Investment & Securities Co.

“It won’t be until Samsung comes along with the diffusion Galaxy A lineup and Galaxy S6 early next year that we should be able to determine whether there will be a meaningful growth,” Lee added.

Samsung Electronics is estimated to log 4.7 trillion won (US$4.4 billion) in operating profit in the last quarter of this year, compared with 4.1 trillion won posted in the previous quarter, according to a poll by Yonhap Infomax, the financial news arm of Yonhap News Agency.

Its shares dipped 1.46 percent to end at 1,217,000 won on Tuesday, with the benchmark KOSPI also closing down 0.91 percent on the Seoul bourse.