- California Assembly OKs highest minimum wage in nation

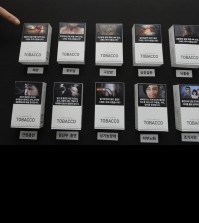

- S. Korea unveils first graphic cigarette warnings

- US joins with South Korea, Japan in bid to deter North Korea

- LPGA golfer Chun In-gee finally back in action

- S. Korea won’t be top seed in final World Cup qualification round

- US men’s soccer misses 2nd straight Olympics

- US back on track in qualifying with 4-0 win over Guatemala

- High-intensity workout injuries spawn cottage industry

- CDC expands range of Zika mosquitoes into parts of Northeast

- Who knew? ‘The Walking Dead’ is helping families connect

Won hits lowest level against US dollar in 5 1/2 years

An electronic signboard at KEB Hana Bank in Seoul shows the closing exchange rate of the South Korean won on Jan. 11, 2016, which ended at 1,209.80 against the U.S. dollar. The local currency fell to 1,210 won per greenback during trading, the lowest in 5 1/2 years, as cross-border tension on the Korean Peninsula and China’s market shock discouraged investors. South Korean shares lost 1.19 percent. (Yonhap)

By Kim Jae-won

The won hit its lowest level against the U.S. dollar in five and a half years on Monday as investors kept moving to safer assets out of fear of the volatile Chinese market, analysts said.

The local currency closed at 1,209.80 won per dollar, losing 11.7 won, or 0.98 percent, from the previous session. It was the weakest level since July, 2010.

The benchmark KOSPI dropped 22.78 points to 1,894.84, sinking below the 1,900 line in four months. The tech-savvy KOSDAQ finished at 674.96, down 7.60, or 1.11 percent.

“The weak Chinese yuan played a key role in pressuring the Korean won to lose its value,” said Jeon Seung-ji, an analyst at Samsung Futures. “Strong U.S. employment data along with low oil prices also raised the won/dollar exchange rate.”

The U.S. government announced Friday that it added 292,000 jobs to its nonfarm payroll in December, raising expectations that the Federal Reserve will hike its interest rate further. The Fed raised its key rate by 25 basis points in December, marking the first rate hike in nearly a decade.

Jeon said that the local currency will be under pressure to be weak for some more time because investors are doubtful of the Chinese government’s ability to stabilize its financial markets.

Ryu Yong-seok, an analyst at Hyundai Securities, said foreign investors led the downturn in the KOSPI, net selling more than 400 billion won.

“Foreign investors have unloaded their stocks since last week, worrying that poor economic data in China will weigh on the global economy.”

Foreign investors offloaded a net 418.2 billion won while individual investors bought a net 256.8 billion won. Institutional investors scooped a net 86.1 billion won.

He said that the KOSPI will continue to lose steam until new signs of recovery are shown in the real economy.

Shares of LOEN Entertainment closed 5.47 percent higher at 82,900 won on the secondary KOSDAQ bourse thanks to the announcement that Korea’s top mobile messenger operator Kakao will take over a controlling stake in the company. Kakao edged down 0.43 percent to 114,700 won.

Large cap shares ended mixed, leading the decline in the overall index. Tech giant Samsung Electronics lost 1.62 percent to end at 1,152,000 won, with the top portal operator Naver sliding 3.68 percent to 628,000 won.

Chip giant SK hynix lost 3.54 percent to end at 28,650 won. Top automaker Hyundai Motor gained 2.56 percent to finish at 140,000 won with its smaller affiliate Kia Motors advancing 2.27 percent to end at 49,600 won.

![일본 사도광산 [서경덕 교수 제공. 재판매 및 DB 금지]](http://www.koreatimesus.com/wp-content/uploads/2024/07/PYH2024072610800050400_P4-copy-120x134.jpg)