- California Assembly OKs highest minimum wage in nation

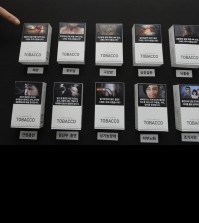

- S. Korea unveils first graphic cigarette warnings

- US joins with South Korea, Japan in bid to deter North Korea

- LPGA golfer Chun In-gee finally back in action

- S. Korea won’t be top seed in final World Cup qualification round

- US men’s soccer misses 2nd straight Olympics

- US back on track in qualifying with 4-0 win over Guatemala

- High-intensity workout injuries spawn cottage industry

- CDC expands range of Zika mosquitoes into parts of Northeast

- Who knew? ‘The Walking Dead’ is helping families connect

Lone Star again wins tax refund case

SEOUL (Yonhap) — A Seoul administrative court again ruled Friday that the state tax office should refund Lone Star Funds 177.2 billion won (US$159 million) in taxes collected from the U.S. buyout fund in its sale of a stake in Korea Exchange Bank (KEB).

In June 2007, Lone Star, which bought KEB in 2003, sold part of its stake in the lender for 1.19 trillion won via a block sale. In 2012, Lone Star sold the rest of its stake to Hana Financial Group for 3.91 trillion won.

Local tax authorities withheld 10 percent of the sale proceeds in capital gains taxes. Challenging the taxation, LSF-KEB Holdings, Lone Star’s subsidiary, filed a suit against the Namdaemun Tax Office.

Ruling partially in favor of the plaintiff, the Seoul Administrative Court said Friday that the office should return 177.2 billion won in transfer taxes.

The court ruled that a capital gains tax should be levied on an actual beneficiary of the proceeds of the sale, saying that the gains eventually belong to U.S.-based Lone Star, not its affiliate in Belgium.

The ruling follows a June ruling in which the court also ordered the tax office to return 119.2 billion won in taxes.

Lone Star would be able to have more than 300 billion won returned if the two rulings are upheld by the Supreme Court.

Lone Star claimed that the tax should be exempted because the actual seller of KEB was based in Belgium, with which South Korea has a double-taxation avoidance deal. Belgium exempts taxes on income from overseas equity investments.

In this case, the U.S.-based Lone Star Funds did not have a duty to pay taxes in Seoul, according to the court.

A tax treaty signed between Seoul and Washington stipulates that a resident living in one country is exempted from taxation by the other nation in cases including stock sales.

Korea’s tax authorities claimed that Lone Star had a duty to pay taxes to Seoul as it had been running its business for a long period of time and made a significant amount of capital gains here.

Lone Star exited from the Korean market when it sold its entire 51.02 percent stake in KEB to Hana Financial Group in 2012. But the tax row involving Lone Star still lingers as the company has been frequently criticized here for pocketing a huge amount of profits and exiting the country without paying taxes.

*This article has been updated.

![일본 사도광산 [서경덕 교수 제공. 재판매 및 DB 금지]](http://www.koreatimesus.com/wp-content/uploads/2024/07/PYH2024072610800050400_P4-copy-120x134.jpg)