- California Assembly OKs highest minimum wage in nation

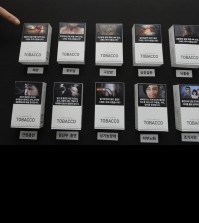

- S. Korea unveils first graphic cigarette warnings

- US joins with South Korea, Japan in bid to deter North Korea

- LPGA golfer Chun In-gee finally back in action

- S. Korea won’t be top seed in final World Cup qualification round

- US men’s soccer misses 2nd straight Olympics

- US back on track in qualifying with 4-0 win over Guatemala

- High-intensity workout injuries spawn cottage industry

- CDC expands range of Zika mosquitoes into parts of Northeast

- Who knew? ‘The Walking Dead’ is helping families connect

A year after debut, IKEA becomes social phenomenon in S. Korea

People line up in front of the Swedish furniture brand IKEA store in Gwangmyeong City, south of Seoul, on Dec. 18, 2014. IKEA plans to open four more stores in South Korea in the near future. (Yonhap)

Plan announced to open five more stores by 2020

By Kim Eun-jung

SEOUL (Yonhap) — It took seven years for Swedish furniture behemoth IKEA to enter South Korea, but it couldn’t have come at a better time to target the nation’s growing number of single-person or small households.

The result? Its entry into Asia’s fourth-largest economy has brought about a seismic change to the retail home furnishing landscape and become a smash hit.

IKEA burst onto the Korean retail scene with its biggest store in the world in Gwangmyeong, just southwest of Seoul, drawing over 6.7 million visitors and logging 308 billion (US$261.8 million) in sales since its launch in December 2014.

The Scandinavian furnishing style presented in showrooms, as well as flat-pack order and self-assembly, has attracted crowds of customers. The sprawling mega store even faced temporary closure earlier this year to control customer traffic after nearby residents complained about massive traffic jams on the weekends.

IKEA officials say the instant hit in South Korea was “far beyond expectations,” which led it to scale up its expansion plan to open five more stores by 2020.

“It’s difficult to say whether we’re too early or too late. Overall, we’re happy how IKEA has been perceived here in Korea,” Andre Schmidtgall, country retail manager at IKEA Korea, said at a press conference. “Personally, I would have wished to enter the (Korean) market earlier.”

Its two-story building spanning 59,000 square meters presents about 8,600 products and 65 showrooms with a child-care area and a cafeteria featuring Swedish meatball and kimchi salmon rice.

This year, the firm’s net profit rose 5.5 percent to 3.5 billion euro ($3.84 billion), thanks to better-than-expected sales in South Korea and record revenue growth in Germany. The 72-year-old firm operates 328 stores in 28 countries.

Schmidtgall said the key of IKEA’s success lies in the affordable prices for people who want to decorate their houses with a limited budget, while showrooms and catalogs inspire people to select a lifestyle, not just a product.

The official said IKEA has served as a “category innovator” by stimulating healthy competition in the sector.

“There are so many possibilities in the (Korean) market. I think there will be a big growth in terms of the home furnishing in Korea,” he said. “We are creating more interests in the home furnishing market.”

It turned out that Korean customers were receptive to “do-it-yourself” shops, while IKEA’s modern aesthetic design seems to appeal to local taste.

“I’ve heard a lot about IKEA, so I wanted to check out the store myself,” said Kim Se-young, a 27-year-old female shopper from Incheon, a nearby port city. “I was inspired by showrooms coordinated with furnishing accessories, and also surprised by the prices being lower than I expected for the Scandinavian furniture.”

Even before IKEA’s entry, Korean furniture makers benchmarked its clean, simple design to open sleek stores with showrooms, which have helped industry leaders to log better earnings in the business-to-consumer side and online channels this year.

Several books related to IKEA and its business philosophy, as well as do-it-yourself home decor books, were published over the past year.

The robust performance was considered an impressive feat at a time when local retailers are grappling with stagnant consumption, partly stemming from record-high household debt and a tight job market.

Some say that the atmosphere encouraging thrift spending and openness to foreign brands well positioned the ready-to-assemble furniture maker in the Korean market.

“I think IKEA fits well into the lifestyle of people who move often due to lease contracts or jobs. Its furniture doesn’t last long, but for that price, it’s OK,” said Kim Sung-bong, an office worker living in a two-bedroom flat in western Seoul.

While IKEA officials held positive for the expansion plan, tasks remain for its sustainable business in the nation with tougher regulation on mega franchise businesses.

A map product labeling the East Sea as the Sea of Japan also sparked backlash in February amid fraying ties between Seoul and Tokyo, prompting the nation’s project leader to apologize. The company said its pricing policy considers a mix of factors, including foreign exchange and tariff rates in each country.

The company has also been embroiled in a number of consumer complaint cases, though its prices are still lower than the traditional furniture makers in the nation.

Potential challenges remain as some lawmakers have pushed to include IKEA in the mega mart category, which could force its store to close down every other Sunday, like other big retailers like E-Mart Co. and Costco.

Schmidtgall said demands for a “win-win” business strategy are “a unique Korean thing,” pledging to step up communication with the local community and officials to handle related issues in the future.

“We, as a global company, have to learn that the regulations are different from market to market.”

![일본 사도광산 [서경덕 교수 제공. 재판매 및 DB 금지]](http://www.koreatimesus.com/wp-content/uploads/2024/07/PYH2024072610800050400_P4-copy-120x134.jpg)

Pingback: Latest Furniture Mart News - ELLC Properties Management

Pingback: Research Analysts' Recent Ratings Updates for Restoration Hardware Holdings (RH)