- California Assembly OKs highest minimum wage in nation

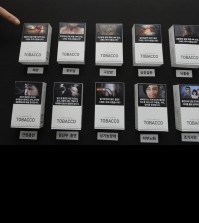

- S. Korea unveils first graphic cigarette warnings

- US joins with South Korea, Japan in bid to deter North Korea

- LPGA golfer Chun In-gee finally back in action

- S. Korea won’t be top seed in final World Cup qualification round

- US men’s soccer misses 2nd straight Olympics

- US back on track in qualifying with 4-0 win over Guatemala

- High-intensity workout injuries spawn cottage industry

- CDC expands range of Zika mosquitoes into parts of Northeast

- Who knew? ‘The Walking Dead’ is helping families connect

Samsung posts 39 pct drop in Q1 earnings

A woman walks by the advertisement of Samsung’s Galaxy S6 smartphone outside its showroom in Seoul, South Korea, Wednesday, April 29, 2015. Samsung Electronics Co. said its first-quarter net income plunged 39 percent as consumers switched to bigger iPhones, squeezing its profit from the mobile business to less than half from a year earlier. (AP Photo/Lee Jin-man)

SEOUL, April 29 (Yonhap) — South Korean tech giant Samsung Electronics Co. said Wednesday its net profit plunged 39 percent in the first quarter from a year earlier due to weak earnings from its mobile business.

Net income reached 4.63 trillion won (US$4.32 billion) in the January-March period, compared with 7.6 trillion won (US$7.12 billion) a year earlier, the company said in a regulatory filing.

Operating profit came to 5.98 trillion won (US$5.6 billion), down 29.6 percent from a year ago, with sales falling 12.2 percent to 47.1 trillion won (US$44.1 billion). The final figures slightly surpassed the earnings preview released early this month, which were 5.9 trillion won (US$5.53 billion) and 47 trillion won (US$44.03 billion), respectively.

The weaker on-year bottom line came as Samsung lost its edge as the world’s top smartphone maker in both the high-end and mid-tier markets.

Although it is estimated that Samsung has sold more smartphones than Apple has in the first quarter, analysts said more customers shifted to the new iPhone 6 and iPhone 6 Plus that came with a bigger screen and hurt Samsung’s profitability compared with the previous year.

Samsung’s profit was also squeezed as it focused more on the low- to mid-end smartphones that have a lower margin. Samsung targeted emerging countries with budget phones to keep its grip against Chinese upstarts like Xiaomi Inc. that stole away market share by cranking out cheaper models.

Samsung’s first-quarter earnings, however, marks its strongest performance in three quarters, signaling that the tech firm is rebounding from the worst earnings it suffered in three years in 2014.

The first-quarter operating profit marks a 13 percent on-quarter gain, following a 30 percent jump in the fourth quarter from three months earlier.

Samsung saw its operating income tumble 61 percent to 4.06 trillion won (US$3.8 billion) in the third quarter of last year, resulting in the weakest annual performance since 2011.

The company cited improving smartphone sales and brisk chip sales as the main drivers of the on-quarter recovery.

Its mobile division logged 2.74 trillion won (US$2.57 billion) in operating profit, far outpacing the market forecast of 2.3 trillion won (US$2.16 billion) polled by local brokerages and a 40 percent on-quarter surge, giving weight to the view that Samsung has bottomed out from its worst days.

Robert Yi, the IR head of Samsung Electronics, told a conference call that it sold 99 million units of handsets in the January-March period, of which more than 80 percent were smartphones.

Market tracker Strategy Analytics said later in a report that Samsung regained the top spot in the global smartphone market in the first quarter, beating its archrival, Apple Inc.

The market tracker said Samsung has likely shipped out 83.2 million smartphones worldwide, grabbing 24 percent of the market, while Apple held an 18 percent share with 61.2 million iPhones sold in that period.

This is a big jump for the Korean smartphone maker that had tied its U.S. archrival in smartphone sales with an estimated 76 million units in the fourth quarter. Samsung does not release the exact figures for smartphone shipments.

Samsung said reduced marketing costs and robust sales of low- to mid-end handsets — the Galaxy A, E and J series released in China and India — also gave a boost to the mobile profit.

But compared with a year earlier, the mobile arm’s operating income plunged 57 percent from 6.43 trillion won (US$6.03 billion).

Shares of Samsung Electronics rose 1.4 percent to close at 1,385,000 won (US$1,298.22) on the Seoul bourse on Wednesday, while the broader KOSPI finished down 0.23 percent.

Samsung said it expects a significant rebound in the mobile sector from the second quarter thanks to the launch of the new flagship Galaxy S6 and Galaxy S6 Edge, while it will continue efforts to further lift sales of its cheaper models in emerging markets.

The semiconductor business generated 2.93 trillion won (US$2.75 billion) in operating income in the first quarter, up 8.5 percent from the previous quarter and 50 percent from a year ago.

Despite the low-demand seasonality, solid demand for mobile and server chips drove up sales, Samsung said. The successful 20-nanometer micro-processing has also helped the company beef up price competitiveness, it added.

Samsung cast a positive outlook for its chip business in the second quarter as the new Galaxy S6 lineup, which went on sale earlier this month, will bolster demand for the chips. The flat-screen Galaxy S6 and its curved-edge variant, the S6 Edge, are installed with a lot of Samsung’s in-house components, including the Exynos 7420 application processor and Shannon 333 for the LTE modem, which bodes well for the company’s future profit.

Samsung logged 520 billion won (US$487.3 million) in operating profit for its display panel division, while it swung to the red in the consumer electronics sector from three months ago, with a net loss of 140 billion won (US$131.2 million).

The depreciation of currencies in emerging markets, such as the sharp decline of the Russian ruble, further slowed the demand for TV sets amid the off-peak season. Samsung said there was about 800 billion won (US$749.4 million) worth of “adverse effects from foreign exchange rates.”

The tech firm said its capital expenditures came to 7.2 trillion won (US$6.7 billion) in the first quarter, with more than half invested in its chip production.

Yi said the annual spending for facility investment will “be about the same level as last year’s,” which amounted to 23.4 trillion won (US$21.9 billion).