- California Assembly OKs highest minimum wage in nation

- S. Korea unveils first graphic cigarette warnings

- US joins with South Korea, Japan in bid to deter North Korea

- LPGA golfer Chun In-gee finally back in action

- S. Korea won’t be top seed in final World Cup qualification round

- US men’s soccer misses 2nd straight Olympics

- US back on track in qualifying with 4-0 win over Guatemala

- High-intensity workout injuries spawn cottage industry

- CDC expands range of Zika mosquitoes into parts of Northeast

- Who knew? ‘The Walking Dead’ is helping families connect

Samsung, LG, SK in auto battery battle

IT-auto partnership becomes popular for biz sustainability

Samsung Electronics recently formed a partnership which BMW, which allows the German carmaker’s i3 electric vehicle to interact with Galaxy Gear smartwatches. (Courtesy of Samsung Electronics)

By Kim Yoo-chul

Connected vehicles have become central to the contemporary driving experience. New technologies and innovations are emerging from both automotive and consumer electronics companies.

Challenges still remain on how effectively new systems, applications, content and context are integrated into vehicles and consumer lifestyles.

But as the collaboration between innovative automakers and technology companies becomes stronger, consumers have more driving choices, safety improves and all industries involved grow, according to officials at some of Korea’s leading technology companies.

“I can say ubiquitous connectivity opens many doors for improved profitability and competitive positioning throughout an expanded ecosystem in the technology industries. This is what’s happening between the car and technology industries. New business opportunities are definitely emerging,” said Brett Sappington, director of research at Parks Associates.

The technology affiliates of Samsung Group, LG Corp. and SK Group ― Korea’s top three conglomerates ― are aggressively exploring territories and opportunities to grow connected car-related technology businesses, which they believe have huge growth potential and could alleviate their worries over corporate sustainability amid challenging situations.

“As Samsung’s growth slows, it needs to find new cash cows other than smartphones, TVs, displays and chips. In line with that perception, Samsung’s top management believes vehicle-related solutions are new business fields from which it could profit in an organized way,” said Hong Sung-ho, an analyst at LIG Investment & Securities.

While Samsung led the global smartphone market last year with a share of over 30 percent, according to market research firm Strategy Analytics, it still faces stiff competition from budget Chinese electronics companies such as Lenovo and Huawei.

In addition, although Apple accounts for only 15 percent of the global market, it recently partnered with China Mobile.

Over 60 percent of Samsung Electronics’ annual profit came from its handset division, and company officials admitted that it should cut its heavy dependence on handsets to diversify its portfolio and boost its corporate sustainability.

To this end, Samsung has taken an interest in in-vehicle infotainment (IVI) units and car batteries.

“Once carmakers demanded their suppliers to ‘open the box’ of IVI ‘head units,’ IVI software development changed. Samsung is working with rivals on the increasing complex IVI infrastructure,” said an unnamed executive at one of Samsung Group’s technology affiliates.

The executive said Samsung is approaching major automakers that they can work with in various IVI-related projects that aim to supply car batteries with better pricing, guaranteed output and on-time delivery.

With the full support of Samsung heir apparent Lee Jay-yong, who currently serves as Samsung Electronics vice chairman, the conglomerate’s battery-making unit, Samsung SDI, has been expanding investment in rechargeable batteries for electric vehicles.

SDI, which suffered 27.4 billion won in losses last year, aims to recover by increasing its sales of car batteries, according to the company.

The Samsung affiliate is working with a regional government in China to construct its first battery plant in Xi’an, where Samsung Electronics is also building a $7 billion flash memory chip plant.

“Recently, Samsung reached an agreement with BMW to supply rechargeable batteries to existing and upcoming BMW electric vehicles, with the aim of diversifying its portfolio amid increasing calls by investors to find new growth engines,” said a Samsung official who declined to be named.

Samsung vice chairman Lee himself drives a BMW i8 electric vehicle. Meanwhile, market analysts say Samsung is impressed by the healthy sales of BMW’s i3 model, which will increase the demand for Samsung batteries.

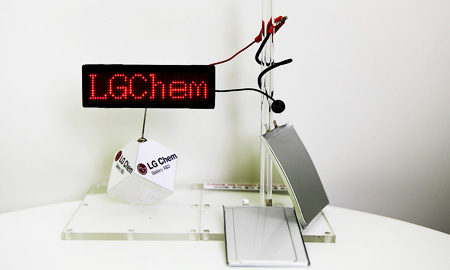

LG Chem-developed flexible batteries are seen in this photo. The batteries will be used in electric vehicles manufactured by its major car clients, including General Motors and Ford. (Courtesy of LG Chem)

LG partners with Renault, Hyundai

LG Electronics is much more aggressive in addressing corporate sustainability concerns.

It plans to end its struggles in smartphones and televisions by restructuring its business units and focusing on car-related businesses, said company officials.

LG is negotiating with some major carmakers, including Renault and Hyundai Motor, about supplying them enhanced dashboard and IVI systems, according to an LG official, adding it recently beat Hyundai’s car-parts affiliate Hyundai Mobis in a deal for IVI solutions.

“Samsung is looking to cut its dependence on smartphones. However, this is a bread-and-butter issue for LG Electronics. We need to grab this opportunity. We are in a desperate situation,” said an LG Electronics executive by telephone.

Indeed, LG will continue to struggle in its key businesses without finding breakthroughs. Its global smartphone share has remained at some 6 percent, pushing it back to a second-tier producer status.

But there’s no guarantee that LG’s shares will significantly increase in the coming years as the market is becoming saturated, which is helping Chinese budget electronics makers.

The latest decision by Lenovo to buy Motorola Mobility is also threatening LG, said market analysts and LG officials.

“LG Electronics’ vehicle component unit is sharing confidential information with LG Chem as LG Chem is a major player that sells car batteries to more than 10 global carmakers. Our plan is to become like Continental and Bosch ― two titans in the world of car components ― by pooling our resources,” said the LG Electronics executive.

LG Chem operates a factory in Korea that supplies batteries for 200,000 electric vehicles annually. It also obtained patents for its supplemental restraint system in Europe, Japan and the United States.

LG reached an agreement with the Renault Group of France about supplying in-vehicle audio-video-navigation systems or AVNs.

In a statement, LG said it aims to develop components and assembly systems such as motors, inverters and converters for electric vehicles at the center, which will house 800 engineers once operational.

“The LG-developed Gen2 infotainment systems will be used for Hyundai’s and Kia’s flagship models this year,” he said.

Hyundai and Kia confirmed that they have become more interested in infotainment systems.

“From safe-driving sensors to voice-and-gesture-controlled infotainment systems to head-up displays with augmented-reality overlays, a plethora of new innovations are coming,” said an official at Kia Motors.

At this year’s Consumer Electronics Show in Las Vegas, Kia Motors Chief Technology Strategist Henry Bzeih and Hyundai Motor Brand and Product Strategy Director Mark Dipko discussed the redefinition of the future of driving.

The collaboration between car and technology companies also provides opportunities for semiconductor-makers as many logic and memory chips are used in electric vehicles.

For example, Samsung plans to expand the sales of its flash memory solutions to Hyundai vehicles.

SK Innovation, the battery-making unit of SK Group, is also investing in China in a strategic collaboration with carmakers there.

“By the latter half of this year, SK plans to complete the construction of a battery pack manufacturing line with an annual capacity of 10,000, which will expand to 20,000 by 2017,” said SK in a statement.

Like Samsung Group and LG Corp., SK Group intends to improve its position internationally.

Its purchase of SK Hynix, formerly Hynix Semiconductor, has been regarded as a decision to buy a brand, not a business, in order to gain recognition as one of the most trusted business partners in China.

By 2020, China plans to supply 5 million electric vehicles and plug-in hybrid electric vehicles.

“The proliferation of connected consumer electronics and services has fueled a need for innovation among support services. It’s fair to say that emerging backend technologies that foster greater efficiencies in diagnostics, troubleshooting and resolution, as well as self-help tools and other aspects of service innovation in the tech support or component market, is presenting opportunities that companies can’t afford to lose,” said Patrice Samuels, research analyst at Parks Associates.