- California Assembly OKs highest minimum wage in nation

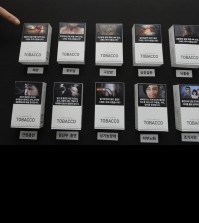

- S. Korea unveils first graphic cigarette warnings

- US joins with South Korea, Japan in bid to deter North Korea

- LPGA golfer Chun In-gee finally back in action

- S. Korea won’t be top seed in final World Cup qualification round

- US men’s soccer misses 2nd straight Olympics

- US back on track in qualifying with 4-0 win over Guatemala

- High-intensity workout injuries spawn cottage industry

- CDC expands range of Zika mosquitoes into parts of Northeast

- Who knew? ‘The Walking Dead’ is helping families connect

“Korea should focus on maritime finance”

Busan in good position to become maritime financing center in Asia

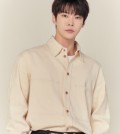

Joris Dierckx, country head for BNP Paribas Korea, stand in front of his office in Seoul after a recent interview. (Korea Times photo by Shim Hyun-chul)

By Kim Rahn

Korea should focus on developing itself into a center of maritime finance rather than trying to become an across-the-board financial hub for Asia, said Joris Dierckx, BNP Paribas’ country head for Korea.

He pointed out that Korea is not in a good position to compete with Singapore and Hong Kong in many aspects so that it should concentrate on fostering a specific financial function.

Dierckx, who is also the head of BNP Paribas Seoul Branch, said copying or trying to compete with Hong Kong or Singapore will not help Korea achieve its goal because these countries have geographic advantages over Korea.

“Hong Kong provides access to China and to the southeast coast of China, where there is so much economic hinterland, which Korea simply does not have. Singapore is a leading trading center as one third of the oil supply of the world goes through Singapore,” said Dierckx in a recent interview with The Korea Times.

However, he suggested that Korea focus on specific financial sectors, citing Luxembourg, Switzerland and the Netherlands, which have high foreign exchange volumes, as examples ― Luxembourg is a big trading center for funds; Switzerland is famous for wealth management; and the Netherlands is a treasury center for non-European companies’ European businesses.

“Korea can play a distinct role. For example, I’m much more of a believer in the strategy to make Busan a hub of maritime financing or certain types of derivatives because it’s very specific and related to certain industries in which Korea has demonstrated strength, so it has something to anchor to,” he said.

“It needs to be a niche, very well thought through and related to innovation. It needs to be a sector that is strong domestically.”

In terms of regulation, Dierckx said Singapore is more open than Korea, but a simple comparison of the countries would not be accurate because Singapore has a much smaller population than Korea and does not have an underlying manufacturing industry, while Korea does.

He said Korea’s business regulations are not discriminatory against foreign firms, particularly in banking, because the same rules apply to domestic and foreign banks. He said some Korean policies are different from those of foreign banks’ home countries and may limit their operations, but the Korean government and the National Assembly created those policies because they were appropriate for Korea.

“We are guests of the country, so it’s not for us to set regulations. We can provide examples and demonstrate how things go in other countries, but mainly, we should adapt to the local environment,” he said.

Different roles from Korean lenders

Dierckx said foreign banks, especially corporate and investment banks, have different roles from domestic banks.

“We cannot, and it’s not our role to, compete with domestic banks because they can do all of the things that we cannot, in terms of Korean won funding, etc. We need to be complementary, meaning we should offer products and bring things to the market that domestic banks do not.”

He said that’s what BNP Paribas has been doing — with well-developed international networks, BNP Paribas’ services both help Korean firms’ overseas expansion and introduce foreign financial products to Korea.

“Korean companies have very much established their presence in the U.S., and now, they are looking at the European markets. So, they need banks to get access to these markets, finance their products and their expansion in the markets, manage their foreign exchange risks, issue guarantees and arrange payments. So, our goal is to continue to develop that link, linking Korea to international markets.”

The other role is bringing foreign financial products to the Korean market, providing access to capital markets and products around the world that Korean players do not have, he said.

Regarding Korean financial firms’ overseas expansion, Dierckx said they have difficulty in generating new capital for their expansion. He said Korean firms have focused on the domestic market and thus, have less technical know-how on international operations such as on foreign exchanges, interest rate products and derivatives related to foreign exchange rates.

“Owing to constraints in the domestic market, Korean financial firms have a somewhat limited experience in international markets, restraining their capacity to enter overseas markets.”

He also suggested that firms avoid trying to achieve good results from their overseas businesses in a short time, saying many successful international banks have decades-long experience, for example, BNP Paribas’ 140 years of operations in India.

“It’s a gradual process; you can’t do it in a short time. You can’t go out and buy banks everywhere and become an international bank in 10 years. It’s incremental; you need to go out, gather experience and train generations of management.”

About concerns over foreign financial companies’ reduction of their Korean operations, Dierckx said it is part of doing business according to changes in the global financial environment and does not necessarily mean that the firms are withdrawing from the market. “Financial assets held by foreign banks have always gone up. Now, they’re flat but not going down. They’re stable.”

About BNP Paribas in Korea

France-based BNP Paribas has a presence in about 80 countries. It has enjoyed top positions in many countries through its three core activities — retail banking, investment solutions and corporate and investment banking (CIB).

The eurozone’s largest banking group started operations in Korea in 1976. It offers financing, advisory and capital market solutions through its CIB businesses at BNP Paribas Seoul Branch and BNP Paribas Securities Korea.

Insurance and asset management solutions are provided through two joint venture companies with Shinhan Financial Group — BNP Paribas Cardif Life Insurance and Shinhan BNP Paribas Asset Management, respectively.