- California Assembly OKs highest minimum wage in nation

- S. Korea unveils first graphic cigarette warnings

- US joins with South Korea, Japan in bid to deter North Korea

- LPGA golfer Chun In-gee finally back in action

- S. Korea won’t be top seed in final World Cup qualification round

- US men’s soccer misses 2nd straight Olympics

- US back on track in qualifying with 4-0 win over Guatemala

- High-intensity workout injuries spawn cottage industry

- CDC expands range of Zika mosquitoes into parts of Northeast

- Who knew? ‘The Walking Dead’ is helping families connect

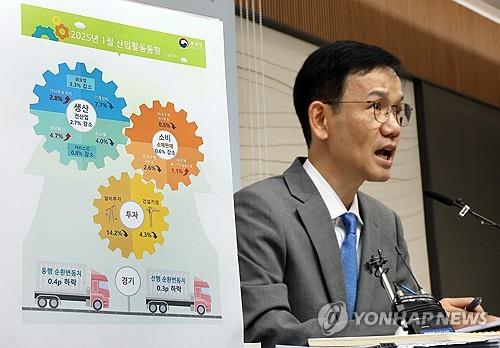

Industrial output, retail sales, facility investment lose ground in Jan.

South Korea’s industrial output, retail sales and facility investment fell from a month earlier in January, data showed Tuesday, raising concerns about a prolonged economic slowdown.

Industrial production went down 2.7 percent last month, reversing a brief gain in December that followed three consecutive months of decline, according to the data compiled by Statistics Korea.

Retail sales, a gauge of private spending, went down 0.6 percent from a month earlier in January.

Facility investment saw a sharp decline in the month, falling 14.2 percent from the previous month.

This marks the first time since October that all three indicators have fallen simultaneously.

“Most key indicators showed negative growth due to the base effect from the previous month’s increase and a reduction in working days caused by the long Lunar New Year holiday,” said Lee Doo-won, an official from Statistics Korea. This year’s annual traditional holiday was extended to six days until Jan. 30.

The decline in industrial output was attributed to decreased production across all major sectors, including manufacturing, services and construction.

In the manufacturing sector, semiconductor production surged 20.8 percent on-month but was partly outweighed by a sharp decline in automobile production, which tumbled 14.4 percent on-month, and that of primary metals, which fell 11.4 percent.

The output in the construction sector has posted on-month declines for nine consecutive months as of January.

In on-year terms, overall industrial output went down 3.5 percent in January.

Retail sales showed a mixed performance. Sales of semidurable goods, such as clothing, dipped 2.6 percent on-month, offsetting a 1.1 percent gain in sales of home appliances and other durable goods.

However, compared with the same month last year, retail sales remained unchanged.

“The recovery in domestic demand is slow,” Lee said, noting retail sales showed little growth despite the holiday period, which typically drives higher spending.

Facility investment weakened in all major sectors.

Construction investment slipped, with construction orders dipping 4.2 percent from a month earlier, marking the ninth consecutive month of decline. From a year earlier, orders plunged 25.1 percent.

The finance ministry said the government plans to step up efforts to revitalize the domestic economy and support exports, as downside risks to the economy are increasing due to heightened internal and external uncertainties.

In line with its first-quarter countermeasure plan, the government will push forward key policy initiatives at a swift pace and continue to devise additional support measures, the ministry said.

The measures include a set of assistance programs, such as export vouchers and a record high 366 trillion-won (US$250.3 billion) trade finance scheme, designed to support export-oriented firms expected to be impacted by global trade uncertainties triggered by U.S. tariffs.